QROPS in Spain -Many expats have taken advice and established a QROPS while in Spain. Some may have made a profit since the transfer but we suspect many thousands have not. We will come onto the costs of taking QROPS Advice in Spain in a future blog.

QROPS in Spain – Taxation

We have covered some of the myths about QROPS in previous blogs but this blog is about having a QROPS while resident in Spain.

Both a QROPS and a UK pension allow the funds to grow in a ‘tax free’ environment (excepting withholding taxes). There are no taxes on capital gains or income with both pension arrangements. Inheritance Tax is also a neutral issue, as it is not generally applied to pensions.

We haven’t found a tax advantage that a QROPS has over a UK pension yet for funds that will not exceed £1.03 million.

QROPS in Spain – the Double Tax Treaty (DTT)

So what about the DTT? The two most popular jurisdictions that, in recent years, have accepted transfers to a QROPS are Malta and Gibraltar. Malta has a Double Tax Treaty with Spain but Gibraltar does not. Given that the UK has the same provisions as Malta in its DTT with Spain, there is no advantage in holding a QROPS in Malta when compared to holding a UK pension.

Without a DTT with Spain, Gibraltar is not a good place to hold a QROPS. Moreover, Gibraltar has less flexible rules about taking an income than both Malta and the UK. You definitely should not be holding a QROPS in Gibraltar!

So; no advantages for QROPS here!

QROPS in Spain – the Charges

We often hear comments that a QROPS has lower charges than a UK pension. Well, no, the opposite is true . QROPS and the investment vehicle, the insurance bond, beloved by so many offshore advisers, have much higher charges than a UK pension.

Oh, so no joy here either!

QROPS in Spain – Access to your money

- Well, this must be better in a QROPS. No, this isn’t correct either.

- How about passing the fund on to my children; is this better in a QROPS? No it is not and for those over 75 it is possible to provide extremely tax efficient generation wealth planning with the UK pension rules. Rarely discussed on adviser forums and websites.

Is there any advantage to having a QROPS as a Spanish resident?

To you, no. To the advisers that advised you, yes. Think commission!

Some essential questions for those that have a QROPS in Spain

- Did you take tax advice from a local Spanish tax adviser? This is a must.

- Are you aware that the Spanish system does not recognise trusts? A QROPs is a trust and tax advice is needed.

- Do you declare your QROPS on the Modelo 720? Speak to a Spanish tax adviser and ask.

- Were you told that the pension would be treated as a temporary annuity and that you would pay reduced tax in Spain? You really should speak to the Spanish tax adviser.

- Is there any reason I have a QROPS? Yes; commission for an adviser. Check this Link to TMP

- Is there any reason I have an Insurance bond in a QROPs? Yes; commission for an adviser Link to TMP

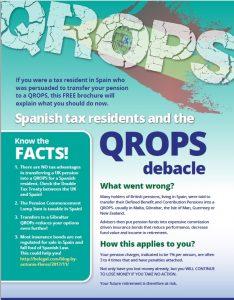

QROPS in Spain – The QROPS Debacle

A QROPS is of little benefit, whatsoever, to a Spanish resident.

Check this

We strongly suggest that you:

- Take advice from a fully regulated MiFID adviser about your QROPs. We can assist you

- Take advice from a local Spanish Tax Adviser to properly understand your position and obligations

If you do not act on this, your pension will pay a high price.

Take action now..!

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

This article was published on 25th July 2018

Related Stories:

- QROPS in Spain

- Pensions in Spain

- QROPS in the UAE

- USA residents with QROPS? – There May Be Trouble Ahead

- Spain- Insurance bonds in pensions, is there a tax advantage?

Share this story