QROPS and Flexible Access Rules Updated

Flexible Access Rules 2015 to 2016 – The Story so Far!

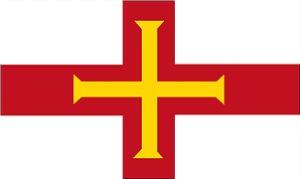

In my previous article – Guernsey QROPS Rules– I talked about the opportunities open to those with QROPS held in Guernsey as a result of the withdrawal of Guernsey as a QROPS jurisdiction and the QROPS and Flexible Access Rules

Now, I would like to talk about some of the less than positive implications of moving a Guernsey QROPS to take advantage of the new QROPS and Flexible Access Rules in 2016.

UK Flexible Access Rules 2015

The new changes came into being last April for those wishing to access benefits over the age of 55. This flexible access was also extended to include EU QROPS. So, some jurisdictions are looking their own QROPS and Flexible Access Rules.

The 70% Rule

HMRC stated that they wished to maintain the 70% rule temporarily for those jurisdictions not in the EU. How long is temporary? No one knows at this stage.

The 70% rule refers to funds transferred from the UK that must provide an “income for life”, in other words- No Flexible Access. How is this going to affect non-EU jurisdictions that offer QROPS and Flexible Access Rules

Guernsey Flexible Pension Benefits

Guernsey introduced flexible benefits in October 2015. But, and it is a BIG BUT, this cannot take preference to the UK rules that enforce the 70% rule on non-EU states. This would also include some of the popular QROPS jurisdictions such as the Isle of Man and Gibraltar.

It is likely that the transfer of Guernsey QROPS to another Guernsey pension with flexible benefits could bring the funds into the UK Inheritance Tax regime. Something most would want to avoid at all costs if UK domicile. Therefore, QROPS and Flexible Access Rules for each jurisdiction need close analysis

At this stage we are also not able to comment on whether such a transfer could be deemed to be an unauthorized payment, thus invoking a 55% sanction charge on the funds.

Options?

- Leave the QROPS as it is in Guernsey, subject to a thorough review of charges and value for money ( and tax treaties )

- Reverse the QROPS back into a UK SIPP

- Transfer to another QROPS jurisdiction that does allow flexible benefits where the QROPS and Flexible Access Rules are more certain.

Advice is paramount, get it wrong and the tax charges and fees could damage your retirement irrevocably.

There are unscrupulous advisers according to newspapers such as the Telegraph that rip off clients due to hidden commissions that were not declared to the client, who in the words of the Telegraph cost british expats billions in hidden charges and suspect funds. Avoid these advisers at all costs.

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

Related Stories:

- Guernsey QROPS Rules – Flexible Pension Access

- Channel Islands Financial Ombudsman

- RL360 QROPS Investment

- What can I do with my Gibraltar QROPS?

- Access Your QROPS Within 5 Years

Share this story