Offshore bonds in pensions have been widely used by non-UK IFAs and we recently posted a blog about insurance bonds that discussed the responsibility of advice.

Offshore Bonds

As we stated in our insurance bond article, there are genuine financial planning reasons for those that live in highly taxed jurisdictions, as an example, to use these bonds to defer and plan tax payments.

Offshore bonds in pensions and tax savings

I have just come off the phone after speaking to a UK expat in Spain that was recommended to transfer from his final salary scheme into a SIPP. He was then told that the only way to do this was to use an offshore bond in a SIPP, but as he had looked at our website he asked some questions.

He was told that “offshore bonds provided extra tax efficiency to a SIPP ( UK pension ) and that by investing into offshore bonds, he would pay less tax when he retired in Spain.”

To be absolutely clear, this is 100% inaccurate and completely misleading. The SIPP wrapper status takes precedent over any “insurance wrapper” and renders it invalid in Spain for 2 reasons:

- The Spanish authorities will tax all proceeds from pensions as income irrespective of the use of an offshore bond.

- The offshore bond would be taken out in the name of the trustees and not the individual thus rendering any supposed benefits of investment bonds in Spain irrelevant. An investment bond needs to be held in the name of the relevant individual to attract tax benefits, and as per point (1) this is irrelevant in Spain anyway.

Offshore Bonds in Pensions charges

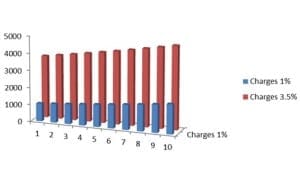

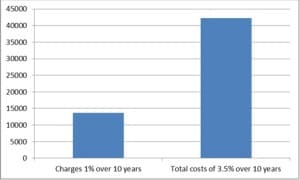

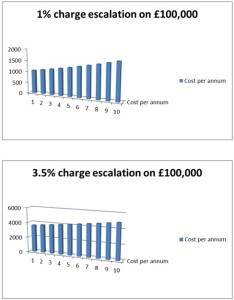

Indeed, when the client pushed on charges he was not told about the 7% commission, and misled with statements about total charges being 1% per annum. The advice given had ignored trustee, commission and fund fee charges; indeed the total annual charge we estimate would be around 3.5% with any IFA servicing charge on top (A 1% annual servicing charge) bringing the cost 4.5% pa

For £100,000 the returns over 10 years would be £39,095 different at 7% annual growth. A 1% charging structure will lead to a fund return at 7% growth of £178,494 as against only £139,399 at 3.5%.

There was a genuine lack of understanding of pensions, tax and double tax treaties on the part of the first adviser.

Double Tax Treaties

The expat in retirement will pay (or not pay) tax depending on the tax treaty between the country where the pension is held and the country of the expat’s tax residency. Offshore bonds in a pension cannot give any tax advantages at all.

The wrapper ( the pension itself ) provides growth free from income tax and capital gains tax and no “tax efficient” investment within it is going to make a difference but it could dramatically add to the cost!

Duty Free Shopping

To help explain this, perhaps I can use an analogy.

Imagine going to the Duty Free shop at an airport and finding someone building a Duty Free shop inside the Duty Free shop. Would you save any tax if you shopped in the smaller shop?

Of course not, the main Duty Free shop ( like the pension wrapper ) provides the only tax benefits, making the additional cost of the Duty Free shop inside ( offshore bonds ) pointless.

QROPS Advisers

We have written before about the qualifications people should look for before taking advice on their UK pensions. While qualifications are no guarantee of integrity, they are at least evidence of knowledge. People in one country, in this case Spain, should not be taking advice on UK pensions from anyone not regulated in either that country or the UK . Ideally the adviser should be regulated in both the UK and Spain in this case, since a SIPP was being recommended as a result of a transfer from a final salary scheme.

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

This article was published on 7th March 2017

Related Stories:

- Offshore Bonds and SIPPs

- Transferring to an International SIPP

- Hidden offshore charges expats should avoid

- Offshore Insurance Bonds Tax Position

- Spain- Insurance bonds in pensions, is there a tax advantage?

Share this story