The FT waves the flag for fee based advice offshore which benefits our OpesFidelio network members ( OF Adviser )

There was an interesting article in the Financial Times claiming that expats could be at the mercy of bandit offshore financial advisers.

While there is an element of “tarring all advisers with the same brush”, the comments about fee based advice and transparency are something we cannot get away from. Our network advisers made a response as OF Adviser and became the Editors Pick for the response.

OF Adviser Perspective

OF Adviser made the point that not all overseas advisers are the same!

The truth is that many offshore advisers meet the regulatory conditions of the local jurisdiction they work in. The issue is that standards vary enormously.

How many regulators / countries insist on transparency, or fees, or qualifications, or have legal enforcement and a separate Ombudsman? The truth is probably less than 6 in the whole world have most of these things, and less than 4 have all of them bar maybe one part.

If you buy a Ford in one country, isn’t it supposed to be of the same quality build as if bought in another? Why should a UK expat, just because he/she lives in another country, not expect the same level of service from a fee based adviser that is not in the UK? This was the point of the FT article and the subject of the OF Adviser response.

Fee Based Advice

There is a myth put about by salesmen that fee based advice is more expensive than product paid (commission) advice. OF Adviser argued against these commission based products and investments as did the FT article.

The issue is twofold:

- Commission only salesmen have to make a sale to make money, and

- The sale has to be linked to a product they have access to.

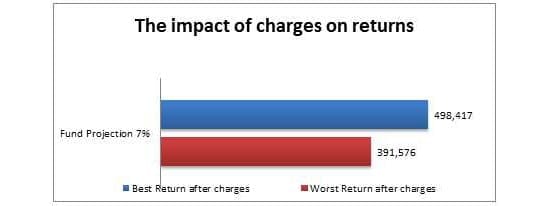

This results in an inappropriate product being recommended as closest to a solution, even where it is unsuitable and the result if often up to five times the cost of a fee based adviser over a 5 year period where people want access at the end of term.

OF Adviser argues that not all advisers are commission based though. A fee based adviser is able to provide objective advice, in the knowledge that there is no requirement for a product sale. While a fee based adviser may recommend several different products, the fees will be transparent and agreed with the client before action is taken. The advice is therefore unbiased and this is what an OF Adviser is, unbiased.

Far too often, commission charges only become apparent months later; at that point, the investor is usually locked into an expensive product with high exit penalties. An OF Adviser does not use these products unless absolutely necessary for tax reasons.

Let’s look at the main issue raised in the article by Jason Butler, and commented on by OF Adviser :-

“If, however, you are already non-UK resident, I suggest you make sure that any overseas financial adviser can prove that they will help you to develop a proper strategic financial plan; that they are prepared to work on a fee only, non-product contingent basis; they will arrange all financial products on a commission-free basis; the adviser holds level 6 financial qualifications; and that they are properly regulated and hold professional indemnity insurance.“

We at Tailormade agree with this statement and would advise expats to look for fee based advice based on the comments in the article.

OF Adviser and FT Summary

The article suggests expats look for the following

- A proper strategic plan for clients

- Fee based advice

- Non-product contingent advice

- Adviser charging on the UK model ( OF Adviser would argue US as well)

- Access to level 6 advisers if needed

- Enforceable regulation and PI cover

There are good offshore advisers like OF Adviser out there – the public just need to ask the right questions.

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article.

This article was published in April 2016

See various video’s about this at our channel TAILORMADE FUTURE.

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

Related Stories:

- The Offshore Independent Adviser

- Financial Advice or Financial Products?

- EU bid to ban financial product commissions faces resistance

- How offshore advisers use regulatory wording to deceive you!

- Independent Financial Advice- Expats

Share this story