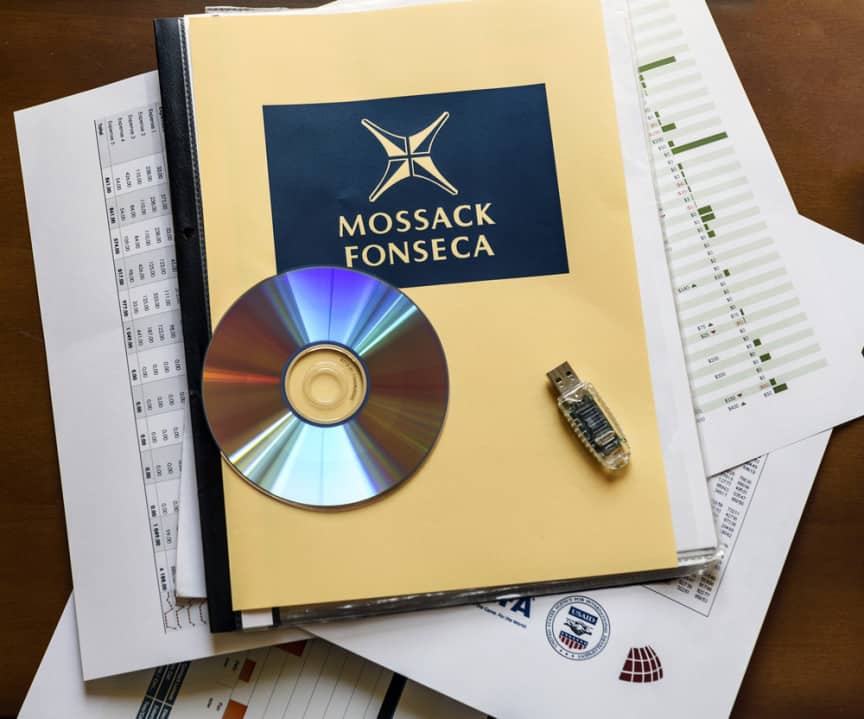

I am one of those people who believe that privacy, not secrecy, is intelligent when you stay within the law- unlike some mentioned in the Panama Papers . We must not “throw the baby out with the bath water” just because someone has money sited in Panama and there has been a despicable breach of trust.

This fact alone does not make it necessarily wrong by default to have financial arrangements sited in Panama; in fact, in most cases it is likely to be within the bounds of legality.

The breach of confidentiality is an issue but it is not just confined to Panama and the Panama Papers. It happened a few years ago at HSBC Geneva, so banks are also vulnerable to such acts, if not more so, if you hold large sums on deposit.

At Stein our view is; if it is not illegal, it is not wrong. However you should choose an Adviser / Organisation that will guide you to where you should site your assets and has established relationships which would make such breaches less likely

Being legally tax-efficient is not just sensible, it is essential to growing your wealth by at least targeting to increase values above bank interest and inflation over the medium to long-term which should be your minimum target.

Our mantra at Stein is there is no point helping clients take decisions that grow their asset values only to give up the gains to unnecessary taxation or a sudden drop in market values due to a market correction.

We are strong advocates of ‘’Legitimate Tax Structures’’ and protecting portfolio values by setting and managing ‘’Automated Stop Loss and Profit Lock-in Strategies’’ around world class Funds and Managers that are robust and fit for purpose

This is being sensible and responsible with your money and utilising the reliefs provided by governments to build your personal assets. Most governments want their citizens to be personally responsible and save money for their long-term future so they are not relying on the State for pensions or benefits

Many countries have announced terms for amnesties on undeclared money in order to bring ‘’Black Money“ back into the system with intentions to move towards cashless economies so the control of money is transparent through information technology.

The technology is already available and when there is a cashless economy and more money is visible in the world system, I wonder if taxes will be reduced. Unlikely I say!

Being Pro-active

Now is the time to become Financially Well Organised in order to ensure you are making the very best use of the approved legal opportunities to protect your assets. This will help to ensure they are passed efficiently to your selected beneficiaries without probate delay or being subjected to unnecessary taxation.

‘’Is this being immoral, or is it being sensible with your money?”

Those who criticise should not criticise individuals, organisations, institutions or companies that use rules to their advantage, but should, encourage the full use of the rules to their own advantage while we have them. Rules are likely to change with advantages lost or at best reduced.

The earlier you arrange your ‘’Financial Planning Structures’’ the more robust they become and the more protection you have from retrospective legislation. This is Tax Planning which is legal as opposed to Tax Evasion which is not. Not all the cases in the Panama Papers were Tax Evasion.

Summary

Tax and succession planning is not dead because of what is written in the press about the so called Panama Papers. Tax and succession planning is alive, healthy and well, providing you stay within the rules. There is no long-term hiding place for money therefore choosing a good experienced, qualified and regulated Adviser who works with experienced Trustees is important as it provides additional layers of protection and expertise.

Choosing your adviser(s) is not only important, IT IS VITAL! If you already have an Adviser and he/she has or has not mentioned Financial Planning or tax shelters and after reading this Blog you are motivated to seek advice, try the following means test;

- Was their Tax Shelter solution a stand-alone International Bond Wrap?

- Have you been sold an Insurance Company Savings Scheme?

- Do you have a Trading Platform Account without a Legitimate Tax Structure with named beneficiaries?

- Have you been recommended to transfer a Final Salary Pension Scheme to an alternative arrangement?

If you have not been advised on the various options to plan towards sheltering tax OR if you can answer yes to any of the four questions above you have been put in financial danger and should seek our advice.

We look forward to hearing from you.

With best wishes

Stuart Langan – member of OpesFidelo / Aisa Direct Ltd

Stein Personal & Corporate Planners

To obtain a private copy of any or all of the following;

- The Stein Business Model

- What is Financial Planning

- Introduction to Legitimate Tax Structures

- The Stein Automated Stop Loss and Profit Lock-in Strategy

- Repairing the Damage of Poor Financial Advice and High Charges

Email Stuart at; stuart@steingroup.biz

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

Related Stories:

- Be Smart, Be Prepared, Be Legal

- Brexit and the Investment Markets

- What is Financial Planning?

- Money Marketing Awards 2021-Aisa Financial Planning

- The Importance of Becoming “Financially Well Organised”

Share this story