QROPS, SIPP? – advertised on many offshore adviser websites as a solution to problems that clients did not previously know even existed! The adverts encourage a transfer without considering the facts, and discourage the idea that the pension could be better left where it is. A QROPS or SIPP is not always going to be in the best interests for those with final salary pension schemes.

Going into 2017 – Why mention this now?

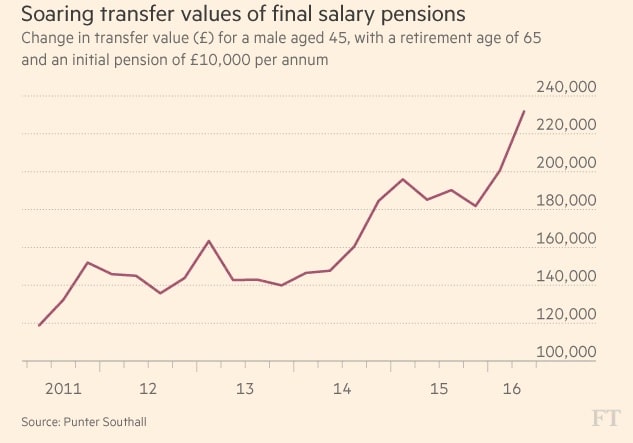

Transfer values are currently at an all-time high. The Financial Times recently referred to an example in May. Three years ago a pension member had a value of £540,000 and by the start of the year it had increased to £740,000. By May it was £818,000 and after Brexit was announced the values went up even more. This year alone there have been increases of 25 to 30% .

There appears to be some confusion among both investors and unqualified advisers as to what a final salary transfer value actually relates to. One thing it is not, it is not the individual pension fund of the client. There is only one pension fund and that is the whole scheme for all the members

The value referred to is the Cash Equivalent Transfer Value, or CETV. It effectively puts a value on the pension benefits accrued in the scheme. To put it another way, you cannot “spend a house” you have to relinquish ownership to get the cash value. The CETV is the value offered to relinquish your final salary pension.

How is this transfer value calculated?

Firstly, the CETV has nothing to do with the markets or the fund value of the scheme (unless the scheme is in difficulty and the value is reduced- but the trustees would inform members if this was the case).

If any consulting actuaries are reading this, I am providing a very basic guide to transfer calculations- so please bear with me.

The Rough Guide to CETV calculation.

- The trustees will to calculate the pension expected at retirement from the pension scheme. This will be determined by the scheme rules and statutory obligations.

- A value of this pension will be calculated with reference to the gilt market. The yields on bonds has fallen sharply and many use 15 to 20 year bonds to place a value on the pension. If the yields fall, the cost of buying the pension goes up.

- The fund needed at retirement is calculated using the conversion rate with regard to the bond yields.

- The actuaries then calculate (using something called the discount rate) what fund would be needed now to give the pension later- The CETV.

The calculations that are used differ from scheme to scheme

“How on Earth is someone like me supposed to get his head around this?”

This was a comment from a client aged late forties with an expected pension of £22,500 pa at retirement. We were told that he had applied for a transfer value a couple of years ago that was in the region of £520,000. His new transfer value is nearly 38 times his expected pension- £840,000.

CETVs are influenced by bond yields and interest rates. So, to explain this, we used only interest rates

If someone wanted £500 pa interest ( if interest rates were 0.25% ) , they would need to have £200,000 in the bank.

But, if interest rates went up to 0.5%, they would only need to have £100,000 in the bank to get £500 pa.

If we were to make the assumption ( only for the purpose of this example ) that is how CETVs were calculated, it shows that the scheme would not need to invest ( or offer as a transfer value ) as much when rates are higher. So, a rise in inflation may lead to a rise in interest rates in this example, and lower transfer values.

Why ask for a CETV now?

Recently published in the Financial Times- this graph shows why!

Pension Scheme Members are entitled to one CETV statement a year without charge. While it may not be the best advice to transfer for many, surely it is worth a “look over the fence” to see if there is now a better reason to transfer than before.

QROPS or SIPP – which is better?

You need personalised advice to answer that question. The options are:

- Leave it where it is and do nothing

- Leave it where it is and review again nearer retirement

- Consider a transfer

We have not suggested that a QROPS or SIPP is the “answer”. Before doing anything, get advice from a registered individual who is regulated in the UK, and make sure you actually speak to the IFA : do not do it through third parties at arm’s length.

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

This article was published 2nd December 2016

Related Stories:

- Final Salary Pension to QROPS

- Final Salary Pension Transfer Advice

- Who should transfer their UK Pension?

- Insistent Clients and Final Salary Pensions

- Final Salary Pension Transfer Critical Advice

Share this story