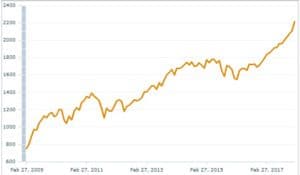

QROPS were introduced as a result of A Day and Pension Simplification in 2006. I first became aware of an increase in the number of adviser adverts in about 2008/9. Sales of QROPS increased dramatically from that year onward, tailing off a little last year as a result of the Overseas Tax Charge in 2017.

This article focuses on both those doing well and badly. We look at the effect of investment markets. We also intrduce forensics review that investors in QROPS may want to consider to assess their options.

The increase in volume of sales of QROPS coincided with the current bull market run (MSCI World Index from February 2009) that is entering its ninth year. As a result some QROPS have done well, but so too have UK pensions over the same time period. Within our company there are clients whose funds have more than doubled, they are UK based pensions.

However, there is a significant minority of QROPS holders that have done extremely poorly despite the very good investment market returns. Some of these people are even forming action groups, but the concern is that no one knows the full extent of the problem as the problem is hidden in a bull market.

QROPS Investment Freedom

One of the oft-cited reasons given by QROPS salespeople is the ‘greater investment freedom’ as opposed to the supposed more restricted UK pensions investment options, as if somehow the investments offered were in some parallel investment universe. Indeed, UK pensions have access to the same world markets as QROPS and can be invested in different currencies- but why let facts get in the way of a sale!

Empirical evidence of a lot of these past QROPS sales is now accumulating. A large percentage of people are nursing significant losses- quite an achievement in a bull market. Many having been sold structured derivative based products, designed for professional investors only and hedging markets, and these are beyond the understanding and risk tolerance of most individual pension holders. It is not just my opinion, that is also the conclusion of the FCA when they reviewed them.

Many of these products are sold by companies without investment licences, although initially this may appear unimportant, and this limits the options for recourse in the event of loss- some losses having been catastrophic.

Many that have fairly reasonable fund selections are hamstrung by excessive charges, often as a result of the expensive insurance bond wrappers and higher fund fees, and are finding that the growth has been minimal or mediocre at best. All the more concerning when compared to the MSCI World Index, clean passive funds/ETFs and even “run of the mill” managed funds.

MSCI World Index

QROPS Market Correction

No one can time the market and no one knows for how long this bull-run will continue but, as sure as eggs are eggs, there will be a correction. Of course, the financial planners that have done their job properly will have correctly analysed their clients’ attitude to risk and capacity for loss and taken into account such an event. However, I fear that those advisers in the QROPS market are in the minority.

When the correction comes, it may be a serious concern to many who were not properly assessed before the investments were made. The other issue will be that many of the charges are fixed and so as a percentage of the QROPS fund the charges become larger, making any recovery limited due to the effect of these charges.

QROPS Review

Given this, I would strongly argue that anyone in a QROPS with an expensive insurance wrapper, in funds that have not performed well, review the funds while the market is up. It may be a lot less painful to do it now rather than later.

Tailormade Pensions can help you with this and identify the options, and the costs, open to those with funds that have may have under-performed during this Bull Run. We offer our Forensic Analysis

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

This article was published on 3rd February 2018

Related Stories:

- Investment Review February 2018

- Low Cost SIPPS and QROPS

- Will this bull market ever end?

- April 2017 Investment Returns

- 10 Reasons to use a QROPS- the facts and the myths (1)

Share this story