Have you heard the latest offshore IFA grift warning people about how a British pension is now subject to Spanish Wealth Tax post-Brexit? Not only that, the advice to avoid the low annual Spanish Wealth Tax is to transfer to a QROPS – though the catch is that the underlying assets have larger costs than the supposed annual tax.

A smaller resulting pension fund and higher fees don’t seemed to be mentioned in the same sales articles. Also, there is no mention of age and how that may impact on whether a pension would be assessed.

Did you know that if all of the above were true (which it is not) then it would effect less than 2 in a hundred people! Jump to the Wealth Tax Rate section to find out if you are affected, or go to the case study.

We have seen a lot of activity by offshore advisers looking to promote QROPS to those with UK pensions that reside within the EU. However, much of it based purely around the opinion of one particular Malta based adviser firm, Blevins Franks. Now, we hold Blevins Franks tax guides in high esteem and we respect their opinion. However, in this instance Blevins Franks have used words like “may be” rather than British pensions “will be” subject to Spanish Wealth Tax.

So, we have asked accountants and tax advisers in Spain about this and not everyone agrees. Most significantly, no-one can cite any cases of actual people under the age of 56 who have been told their British pension fund (not their income or lump sum) will actually be subject to Wealth Tax.

Perhaps the readers of this article can enlighten us.

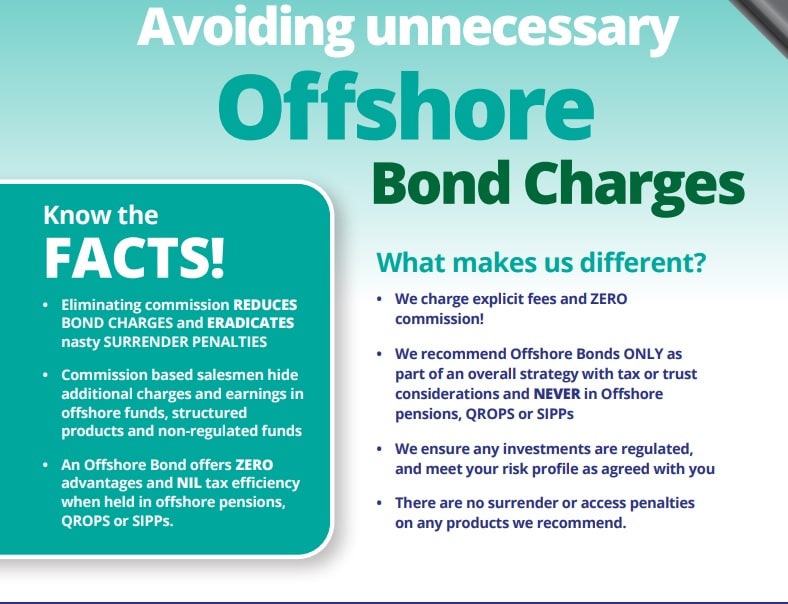

Lots of other less scrupulous firms are jumping onto this idea with the sole aim to transfer a lower cost British pension into a high cost commission based QROPS with high up front earnings for the adviser. An insurance bond from the Isle of Man, Dublin or Luxembourg is sold, which often has high charging funds where the advisers firm get backhanders from selling and holding the funds (or a related company to the adviser firm does).

We are now seeing ‘buy now while stocks last’ adverts that warn that Brexit means that the opportunity to transfer to a QROPS should be taken up immediately. There is no consideration to age, size of funds, cost, negative outcomes, nor size of wealth even (which is ironic as the whole issue apparently is Spanish Wealth tax).

There is nothing like a deadline to create a panic leading to the costly transfer from a pension that was possibly perfectly well left where it was in the UK. Post Brexit, QROPS are still available to those living in the EEA/EU as at the date of this article, and yet these buy now adverts started in 2018.

I guess like the end of the world, one day they will be right, and then they can say, “I told you so”. The real question is whether a QROPS is the correct vehicle for anyone irrespective of Brexit!

What are Wealth Tax Rates in Spain? (Accurate 31 Jan 2022)

There is an initial exclusion per person of 700,000 EUR and a 300,00 EUR main residence allowance and then there is a progressive tax from 0.2% upwards (national rate) for assets above this. This means a couple could hold assets to the value of 2 million EUR and not be liable for any Wealth Tax.

(the rate does increase to 1.3% above 1.3 million Euros but, as referred to below, there may be LTA planning reasons to transfer funds of this size)

Spanish Wealth Tax Case study

Let us look at an example -here we assume an individual Spanish resident aged 60 (NOTE: Over 55 as it appears no-one under 55 is likely to have it applied) owns half of the value of their house (400,000 EUR), 200,000 EUR of investments, savings and assets, and a pension of £500,000 (595,000 EUR) that in an unlikely event ‘could’ face the Spanish Wealth Tax.

Total value of assets would be 995,000 EUR of which the first 900,000 EUR is ‘ Wealth Tax Free’, and the remainder is subject to 0.2%, which equates to 190 EUR per annum.

A quite wealthy person with large pension fund “may” have a tax bill of 190 EURO and so would likely be ill advised to take any action to move to a QROPS.

Why Transfer to a QROPS?

For those with larger funds (heading towards a million pounds), there may be an argument to transfer to a QROPS to avoid an LTA charge. However, beware, as we have evidence that a transfer may become a very expensive alternative to a UK pension, the costs of which wipe out any tax advantages! The real reason some advisers push the idea of a QROPS transfer is simply commission to the salesperson, or because they do not have the licences to advise on the UK pensions; neither of these are best advice for the client!

How much will a Transfer to a QROPS save?

Typically QROPS are sold with an insurance bond (from jurisdictions such as Luxembourg, Ireland or the Isle of Man- and sometimes more exotic locations). These can have a 1% pa charge for up to 10 years and typically a 500 EUR annual fee. They can also have exit penalties if someone wants access/to retire with the first 5 years. Further there is an approximate 900 EUR QROPS fee. The funds recommended are typically commission earning and can charge around 1.5% pa. (It is a sad fact that many unscrupulous adviser firms will use high charged in-house funds or have an ‘agreement’ with an investment company to mix clean funds and commission based funds)

A UK comparison, typically offered by transparent charging advisers, would have approximate costs of 0.2 – 0.3% platform fee, 200 EUR annual fee and fund fees of 0.7% pa (assuming a mix of active and passive clean funds- ie no commission).

If we look at that 595,000 EUR fund again, we can see the cost of the supposed Wealth Tax that may never actually be applied to the UK scheme and the fees of both the UK and the QROPS pensions.

UK pension fees and Wealth Tax (if applied) total 1.03% of the fund value. If Wealth Tax is not applied then the fees are circa 1% pa of the fund value.

QROPS fees (no Wealth Tax) total 2.73% of the fund value.

To put this into hard numbers- we have estimated the additional QROPS fees over an equivalent UK pension (SIPP)-

10,300 EUR pa additional cost compared to a Wealth Tax charge that may never be applied of 190 EUR.

Do you think anyone would still want to transfer to a QROPS to save Wealth Tax having read this?

Summary

We have not referred to ongoing advice fees other than initial commission paid by the insurance company as we wanted to focus on a comparison of product costs based on what is typically sold to British pension holders in Spain. Some fee-based advisers may well recommend QROPS with competitively priced fees, but then they are likely to be the kind of advisers that do not sell a product based on some legislation that may never materialise- no doubt preferring to provide better advice for their clients.

In other words, the advisers most likely to charge the least are also the most likely to not recommend a QROPS in this instance.

That is before we even consider if the Spanish Wealth Tax would actually apply. For sure, in many cases, it would either not apply at all or be so small as to render it irrelevant even on the assumptions made by Blevins Franks.

However, if your pension fund is in excess of 700,000 EUR or your estate value as a couple is in excess of 1,500,000 EUR, and you are approaching 56 or older, then please come and talk to us as we will provide the advice that you are seeking on a fee rather than commission basis. Out fees are fixed and we would not seek to recommend a QROPS over retaining a pension in the UK in order to earn more. We may be able to provide advice about other tax efficient vehicles you can consider for your other investments.

We are not tax advisers and would always recommend people take tax advice before trying to avoid any taxes. The fact is, for the vast majority of people, a transfer to a QROPS to avoid a possible Wealth Tax will be far more expensive than the supposed tax they are being persuaded to avoid!

Article Date 28th January 2022

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not except any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

Related Stories:

- QROPS in Spain | QROPS Advice

- Commission or Fees QROPS – a no brainer?

- Low Cost SIPPS and QROPS

- QROPS Fees, Transparent Charges and Commissions

- British Pension transfers for US Citizens

Share this story