Coronavirus Investment Performance during 2020 and where to invest has been a key topic for all of us in our Investment team. Our portfolios have been running for 11 years, and we have experience and knowledge, but could anything have prepared us for Covid?

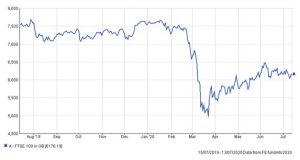

The unhappy FTSE 100 picture

On the left is the FTSE 100 passive tracker performance. Not good at the moment you might think, and you would be right! This article is a republish of an article written in August 2020 and the graph on the left was what it looked like then. However, it has not got any better since and still lies off over 15% this year to November 2020.

What about our Coronavirus Investment Performance? Is it better than the FTSE or other European index?

More to the point, have we got it right for our clients over the coronavirus initial period? Our fund performance is listed below along with a comparison diagram. Clearly, as always past performance cannot be used in isolation as a guide to future performance and funds continue to be volatile and can lose as well as make positive returns.

Back in April I wrote an article about economics and about the performance of passive v active investing strategies (published in Citywire NMA May edition 678). At the time financial markets had dropped significantly with the FTSE 100 falling 34% over 2 months and we were unsure whether it was going to drop further. The article highlighted the fact that using a passive investment strategy, where the majority of funds are index trackers, does not sufficiently protect you from a fall in markets. You may achieve competent returns when markets are growing but during a ‘market collapse’ you will usually see a sharp fall in your investment value.

The other issue as highlighted in a previous quarter is the concentration of an index in just a few shares. The US index tracker has 20%+ in just a few US tech companies and it is prone to a correction when sentiment changes or regulation bites. As such, the AISA Investment Team use only a small percentage of passive tracking index funds, which we believe is the right strategy.

When reviewing the situation in April it was evident that our clients were in a considerably better situation. Comparing the loss of our growth portfolios to be an average of 12% down compared to competitors using 25% to 35% in passive tracking funds at their worst point.

What did wealth managers in general say?

While some wealth managers were advising clients to hold existing investments, our Investment Committee decided to make active decisions. We held an emergency meeting to discuss the ongoing pandemic and assess how we see the situation unfolding. The general agreement was that the world was not going go back to normal anytime soon and we needed to make active changes to our portfolios in an attempt to obtain returns over the next 6 to 12 months, or at least to mitigate potential further losses.

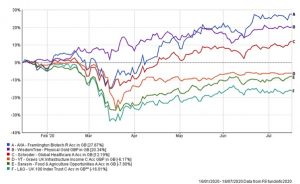

We documented our decision to reduce exposure to airlines, tourism and similar hospitality sectors. We decided to increase allocation to areas such as food and agriculture (both are requirements even during downturns), healthcare (for obvious reasons), biotech (as it was these companies who could discover and manufacture a vaccine), infrastructure (as governments would complete existing construction contracts, especially when it’s time to get the economy going again) and finally a higher allocation to Physical Gold (which would continue to be a good hedge against further market falls).

Over the next couple of months markets recovered well, partly due to actions taken by governments to increase cash flow in economies and assist companies where possible. Therefore, the bottom of this market was mid-March and from this point many funds recovered well. When we look at the specific performance of the 4 new funds that the AISA Investment Team recommended we can see how good these decisions were, especially compared to a FTSE 100 index tracker:

Over the next couple of months markets recovered well, partly due to actions taken by governments to increase cash flow in economies and assist companies where possible. Therefore, the bottom of this market was mid-March and from this point many funds recovered well. When we look at the specific performance of the 4 new funds that the AISA Investment Team recommended we can see how good these decisions were, especially compared to a FTSE 100 index tracker:

Fund Increase over 4 months March to July

AXA Framlington Biotech Acc 37%

Schroder Global Healthcare Acc 31%

Sarasin Food & Agriculture Acc 23%

VT Gravis Infrastructure Income Acc 27%

WisdomTree Physical Gold 17% (note below)

UK FTSE 100 index tracker 16% (note below)

Please note that we are not recommending you buy these funds now! This is a historic Coronavirus Investment Performance during 2020 lookback.

NOTE: While the above figure shows Gold providing a return close to the FTSE 100 trackers, it is important to note that Gold had not dropped before this rise. Therefore, if we said the FTSE 100 dropped by 30% in the previous month followed by a 17% rise, (a net 18% drop), It means over the 5-month period Gold outperformed the index by almost 35%. As our clients were already invested in gold this is the true comparison!

We rarely praise ourselves, and you should understand that past performance cannot be used as any form of guarantee to future performance. However, in rolling 12 month figures our Coronavirus Investment Performance above risk level 5 have outperformed the FTSE 100 index tracker around 85% of the time (Figures compared over last 5 years and published quarterly in our reports).

Impressive Returns

So, whilst you will be happy with us, as the above figures look like impressive returns, we know markets can change very quickly. We continue to work hard for you, and we have just had our July meeting with some further recommendations and changes. Our ongoing portfolio management process will continue to make active investment decisions where necessary in an attempt to protect our clients from future falls and obtain growth in difficult market situations.

If you want to know our thoughts about the V-shaped recovery versus K-shaped then just click here.

To answer the question poised at the beginning; did we get our

Coronavirus Investment Performance during 2020 right for our clients?

Yes.

The views expressed in this article are not to be construed as personal advice. You should contact a qualified and ideally regulated adviser in order to obtain up to date personal advice with regard to your own personal circumstances. If you do not then you are acting under your own authority and deemed “execution only”. The author does not accept any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

This article was published on the 3rd August to our clients, and republished on 9th November 2020

Related Stories:

- Ubiquitous 1% servicing fee on Expat Investments

- Gold and Silver investing

- April 2017 Investment Returns

- The top ETF funds of 2016

- Navigating Q4 Investments in the Wake of Soaring Inflation

Share this story