Image by vecstock on Freepik

Retirement planning uses ages, years, dollar amounts and other key numbers.

Retirement planning requires you to be aware of certain key ages in your life. If you get the numbers right – ages and dollar amounts – you increase your chances of living a great retirement.

On the other hand, if you miss important required actions you must take, based on your age, you can miss out on benefits, and may face paying large penalties.

Age 50 – Catch Up Contributions

At age 50, you can start seeing your retirement over the horizon. If you’ve been saving for most of your working years, that view is golden. If not, your retirement planning may include increasing your savings.

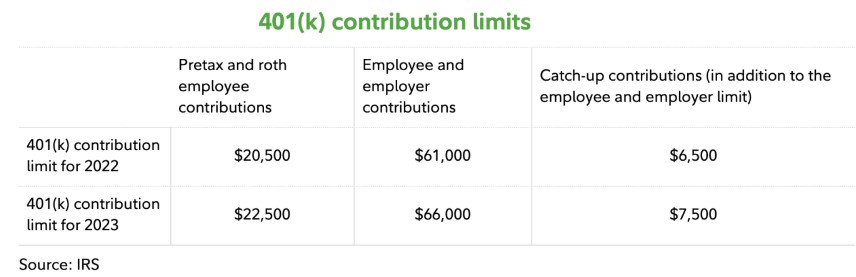

You can make extra ‘catch-up’ contributions to 401(k) plans and other employer-sponsored retirement plans. You’ll win in two ways: first, the money still has time to grow with the market, and second, you can reduce your current taxable income by increasing contributions to these plans.

Your employer may match a portion of your catch-up contribution; however, this is their choice. It is spelled out in their benefits package information.

Notably, a catch-up contribution is allowed only after you’ve made the maximum contribution for the year.

The general limit on total employer and employee contributions for 2023 is $66,000, for a total of $73,500 with catch-up.

Image source: financialsamurai.com

Catch-Up Contributions for SIMPLE Plans

The 2023 regular contribution limit for a SIMPLE IRA or 401(k), which are retirement plans designed for small businesses with 100 or fewer employees, is $15,500. The extra catch-up contribution limit for workers at least 50 years old who participate in a SIMPLE plan is $3,500 for 2023.

Age 55 – If you’ve just left your job

If you leave your job in the year you turn age 55 or older, then you can take penalty-free 401(k) withdrawals from the account associated with your most recent job.

The rule of 55 allows you to avoid the 10% early withdrawal penalty, but income tax will still apply to each traditional 401(k) distribution.

Age 59 ½ – Withdraw from IRAs without penalty

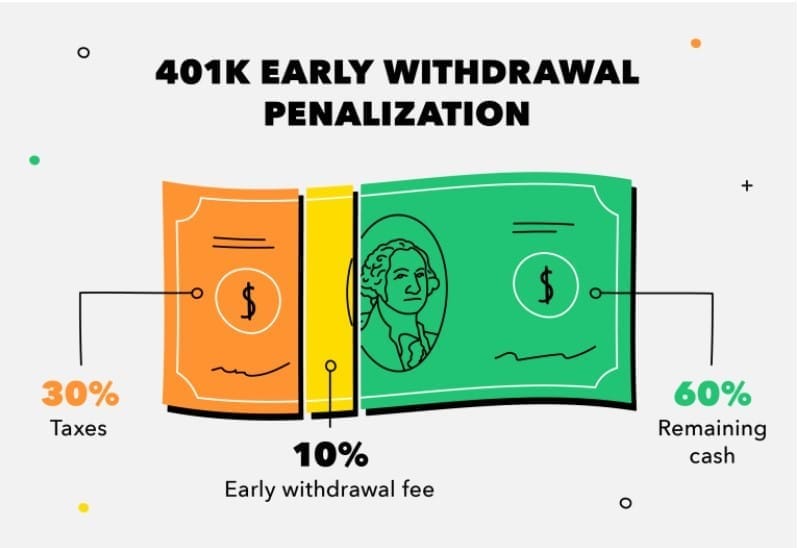

Until you’re age 59 ½, you’ll pay a hefty penalty for withdrawing money from your retirement accounts, with some exceptions.

You must pay income tax on the amount taken, plus another 10% penalty. Currently, tax rates in the US range between 10% and 37%.

Image source: mint.intuit.com

Age 60 – Added catch-up opportunity

The SECURE 2.0 Act adds a “special” catch-up contribution limit for employees 60 to 63 years of age starting in 2025.

In the case of most 401(k) plans and other employer-sponsored retirement plans, the special catch-up contribution maximum for workers 60 to 63 years old is the greater of $10,000 or 150% of the “standard” catch-up contribution amount for 2024. The $10,000 amount will be adjusted for inflation each year starting in 2026.

Age 62 – Social Security available

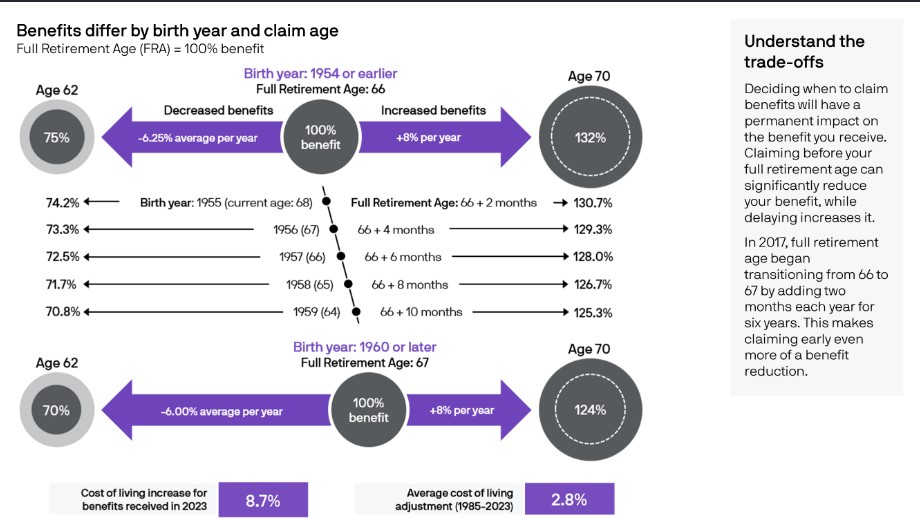

Choosing when to start taking your Social Security is often one of the most important decisions of your retirement planning. There are three important numbers related to when you choose to start receiving your Social Security.

- Age 62 – The minimum age when you can begin receiving Social Security benefits. You will get more years of benefits, but at a reduced rate.

- Age 66 or 67 (depending on the year you were born) – Your ‘full’ retirement age. At this age, you get 100% of your benefits.

- Age 70 – If you wait until age 70, your benefits will be 76% higher than those taken at age 62.

While many people intend to wait longer, Fidelity found that 65% of people claim Social Security before their full retirement age.

Image source: am.jpmorgan.com

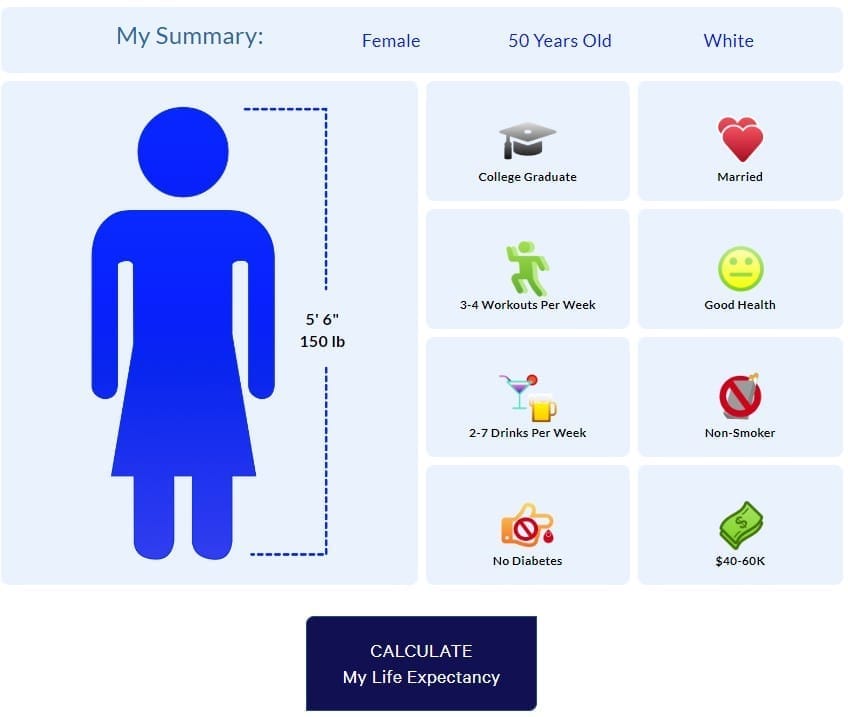

It can help to use a life expectancy calculator to learn the estimate of how long you’ll live. Indeed, your life expectancy age can help you plan for retirement, take out life insurance, or determine when you’ll start taking your Social Security benefits.

The calculators are usually based on your gender, physical health, and lifestyle.

Image source: blueprintincome.com

There are many choices, each uses between two and 50 questions.

Easy life expectancy calculator

More life expectancy calculators

Age 65 – Medicare Health Coverage

One of the biggest concerns in retirement planning is making sure your health and medical needs are covered.

Even if you’re not taking Social Security yet, you must enroll in Medicare within the Initial Enrollment Period (IEP).

The IEP starts three months before the month you turn 65 and lasts until the third month after your 65th birthday month, for a total of seven months.

If you are already taking Social Security, then you’re automatically enrolled in Medicare Parts A and B.

Age 65 – If You’re Still Working

Large employers with at least 20 employees must offer you and your spouse the same medical and health benefits they offer younger employees and their spouses. In this situation, you — not the employer — can decide whether to:

- Accept the employer health plan and delay Medicare enrollment.

- Decline employer coverage and rely wholly on Medicare.

- Have both employer coverage and Medicare at the same time.

Many people enroll in Medicare Part A at 65, even with employer coverage because it’s premium-free as long as you or your spouse have paid at least 40 quarters of Medicare taxes.

However, you may decide to wait if you want to continue contributing pretax dollars to a health savings account (HSA). You can’t make new HSA contributions after you enroll in Medicare.

Age 66 – 67 – Full retirement age for Social Security

You will receive 100% of your Social Security benefits, if you choose to take them.

Age 70 – Maximum Benefit for Social Security

Alternatively, if you wait until age 70 to claim your benefits, you’ll receive 132% of your standard monthly benefit amount.

Any further delay in claiming won’t increase the size of your check.

Age 73 – Required Minimum Distributions

A Required Minimum Distribution (RMD) is the amount of money you must take – and pay taxes on – every year from your retirement savings accounts, starting at age 73. The amount is based on the value of your accounts.

The accounts included are traditional IRAs and employer-sponsored plans such as 401(k)s and Roth 401(k)s.

The SECURE 2.0 Act raised the age from 72 to 73 in 2023. In 2033, the age will once again be raised, this time to age 75.

It should be noted that RMDs do not apply to Roth IRA accounts, until after the owner’s death.

It is important to incorporate this requirement into your retirement planning because if you skip your RMD or don’t take out enough, there’s a 25% penalty of the amount you should have withdrawn.

The SECURE 2.0 Act dropped the penalty to 25% from 50% starting in 2023. There is a possibility of reducing it further to 10% if you take your missed RMD during the “correction window.”

Importantly, be sure to check in with your financial advisor and tax advisors regularly in the years leading up to retirement to assess your progress toward your goals.

See also:

The 401(k) Crash: U.S. Retirees Impacted by Unexpected Losses

How Will You Pay Yourself in Retirement? Part 1

Aisa International, s.r.o. is a wealth management firm with an award-winning team who provides investment advice, financial planning, and asset management for U.S., U.K., and E.U. expatriate citizens residing abroad. Holding all current regulatory licenses, including the FCA license in the UK and the Investment Licence in the European Union, Aisa International is uniquely qualified to provide personal financial advice for U.K. pensioners living outside of the U.K. Headquartered in Prague, Czech Republic, Aisa International serves its global clients where they reside through its OpesFidelio network of highly-qualified advisors. For more information, please visit www.asiainternational.cz.

The views expressed in this article are not to be construed as personal advice. Therefore, you should contact a qualified, and ideally, regulated adviser in order to obtain up-to-date personal advice with regard to your own personal circumstances. Consequently, if you do not, then you are acting under your own authority and deemed “execution only”. The author does not accept any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Importantly, where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

Related Stories:

- US Social Security Rate Hike Biggest Since 1980s

- Retirement Savings- How New U.S. Legislation Affects Them

- Retirement Planning: Consider Cash Flow in Addition to Accumulation

- Saving for Retirement

- PART 1: How Will You Pay Yourself in Retirement?

Share this story