When did $100,000 become a budget-busting income?

Middle-class Americans are making an average of $100,000 a year. Incredibly, over half of them live paycheck-to-paycheck, according to a February 2023 survey.

The magical ‘six-figure’ salary that many believed would signal their financial success is now the minimum needed for many middle-class American families.

There are a number of reasons why they’re feeling the squeeze. For example, rising inflation, the costs of childcare and medical bills, and where they live all factor into the middle-class meltdown.

Middle Class Defined

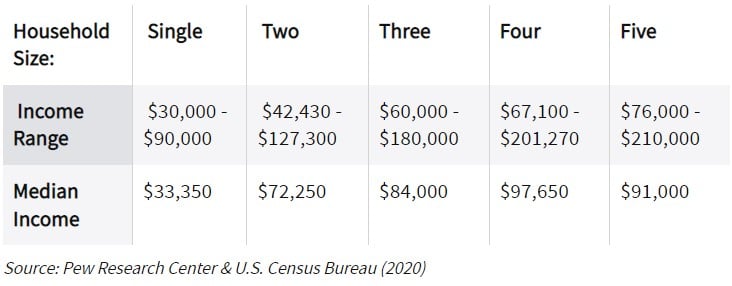

According to the U.S. Census Bureau’s most recent report, the median American income in 2021 was $70,784. Therefore, American families earning between $47,189 and $141,568 are technically in the middle class, according to the Pew Research Center’s definition.

In a 2023 Gallup survey, annual incomes from $40,000 up to $100,000 are considered as ‘middle class’.

Source: Pew Research Center analysis of the Current Population Survey, Annual Social and Economic Supplement (PUMS).

Middle Class Shrinkage

America’s middle-class segment peaked in 1971, at 61% of the population. Then, it gradually declined until 2011, to about 50%, where it has remained until now.

Perceptions of Need Change with Income Level

Americans’ perceptions of the minimum income a family of four needs are influenced by their own financial circumstances (Gallup).

Specifically, those with an annual household income of $100,000 or more project $100,000, on average, as necessary for a family to get by.

In contrast, those with between $40,000 and $99,999 in annual income, estimate that families need about $80,000.

Meanwhile, those earning less than $40,000 believe an income of about $66,000 would suffice.

Overall Feelings of Financial Well-Being

Adults’ self-reported financial wellbeing fell sharply and is now among the lowest observed since 2016, as reported in the annual US Federal Reserve Report Economic Well-Being of US Households in 2022, published May 2023.

The report found that:

- Adults’ responses about their sense of overall financial wellbeing declined five percentage points from the prior year.

- 35% of adults say they are worse off financially than a year earlier, which is the highest level since the question was first asked in 2014.

- 23% percent of adults say that their spending has increased, but their income has not.

A LendingClub report reinforces these sentiments. They found that 61% of those surveyed say they feel stretched too thin.

49% of $100,000 or more earners say they’re living paycheck to paycheck.

Inflation is Impacting Bill-Paying Ability

The declining feelings of financial wellbeing in the middle class may reflect the broader inflation and stock market conditions in 2022.

Admittedly, their feelings are based in fact. Fewer Americans were able to pay their monthly bills in October 2022 compared to the year prior, according to the U.S. Federal Reserve report.

Survey respondents mentioned the increasing cost of food, gas, and utilities.

In fact, 41% of six-figure households said they had to adjust their budgets to accommodate higher prices.

Moreover, some noted that, while prices have increased, wages have often not kept up.

Source: Federal Reserve System, May 2023

Middle Class Savings Are Taking a Hit

More than half – 51% – reduced their rate of savings as a response to inflation in 2022. CNBC reported that Americans had an average of $9,000 less in their savings accounts in May 2022 than they did the year prior.

51% reduced their savings in response to higher prices.

Retirement savings in particular are being used to bridge the gap. As a result, progress toward retirement savings goals declined in 2022.

Specifically, just 31% of workers think their retirement savings plan is on track. This is down from 40% in 2021.

A 2022 Northwestern Mutual report found that average retirement savings dropped 11% from 2021 to 2022.

Supporting a Family is Expensive

A middle-class income of $100,000 may be plenty for individuals to live, save, and pay for emergencies without taking on debt.

However, as households increase in size, the income needed to accomplish this must, of course, increase as well.

A household earning $100,000, “is middle class, but where in the middle class they fall can vary drastically, depending on where they live and how many people they’re supporting,” says Parthean Financial Educator Catie Hogan.

In a recent Buzz article, interviewees shared the sentiment that while earning $100,000 was a relative privilege, it was not living up to their expectations of what making six figures would be like.

Childcare

Americans’ rising estimates of required income may also be linked to the increase of two-income families. Notably, according to the Gallup report, Americans’ average estimate for getting by sits at $85,000.

The researchers point out that this income is more likely attained by families with dual incomes.

Obviously, with both parents working, the need for childcare is a priority. And childcare comes with a big bill.

In Care.com’s 2022 Cost of Care Survey:

- 51% of parents say they spend more than 20% of their household income on childcare.

- 72% of parents report spending 10% or more of their income on childcare.

These figures are far above what the US Department of Health and Human Services (HHS) considers affordable. The HHS determines that daycare is affordable when it costs no more than 7% of household income.

In fact, in most US states, childcare costs exceed the cost of in-state university tuition.

Research conducted by Zippia concludes that the average cost of one child in daycare in 2023 is $340 per week.

Medical Bills

In the US, one of the first priorities is to pay the monthly premiums for health insurance.

The average cost for a 40-year-old couple is $1,077 per month, which is about double the cost for an individual in that age range.

On the other hand, a 40-year-old couple with one child under age 14 pays an average of $1,398 per month.

Furthermore, a family of five pays an average of $2,040 per month (MoneyGeek).

In addition to monthly insurance premiums, six-figure earners shared increasingly common stories of medically-induced financial hardship in a BuzzFeed article.

One interviewee says she incurred almost $15,000 in out-of-pocket medical expenses, because the family deductible is almost $13,000.

Another couple says they had to unexpectedly pay their $2,500 deductible immediately when their daughter needed emergency care for a seizure.

In like manner, a family found themselves with $45,000 of medical debt when their newborn needed daily asthma treatments until he was five years old. That added a $1,000 monthly bill to pay.

Consumers Relying on Credit Cards to Pay Bills

In addition to medical bills, everyday incidentals are ending up on credit cards.

Often the charged expenses are those that have shifted from institutions, like schools, governments, etc., to families.

For example, while kids’ extracurricular activities are healthy and socially beneficial, they are paid for by the parents.

“Now, you need your own bat, you need a helmet, you need a bag, and the batting gloves and everything else just to show up. All my kids’ stuff is secondhand. We probably spend about $500 a month for both of them to do certain camps throughout the year. Then at camp, it’s always, ‘Hey, welcome to the camp. You’ve got to buy the jersey. And then you’ve got to pay for the cage time.’ I want to be a good father, so I coach. They don’t provide you with baseballs! It’s $110 for a bucket of baseballs,” says one father.

According to data from credit score company TransUnion, the balances on both credit cards and installment loans are rising.

In fact, they’ve documented a nearly 20% increase year-over-year as consumers struggle to pay their bills.

When asked for the largest expense they could cover using only savings, 18% of six-figure earners say the largest expense they can cover with savings is under $100.

Furthermore, an additional 14% say the largest expense they can cover is between $100 and $499.

Pandemic Hangover

Many workers lost their jobs – and their incomes – during the pandemic.

According to Northwest Mutual’s “Planning & Progress Study 2022, 60% of US adults said the pandemic was “highly disruptive” to their finances and based on the Federal Reserve report, many households still have not recovered.

For Some, Lifestyle Creep is the Culprit

‘Lifestyle creep’ is the increase in discretionary consumption of non-essential items.

“Studies have shown time after time that living paycheck-to-paycheck has very little to do with income levels,” says Bobbi Rebell, founder of Financial Wellness Strategies and author of Launching Financial Grownups.

LendingClub’s report also reveals that Americans living in cities are more likely to live paycheck to paycheck than those in suburbs, in part because ‘lifestyle creep’ is more common.

Where You Live Affects Your Available Income

In June 2023, SmartAsset published a study where they found that in New York City and San Francisco, $250K is worth just short of $83,000 after factoring in taxes and cost of living.

In other words, a $100,000 salary in New York City is more like $35,791, because of the combination of federal, state and local taxes, along with a sky-high cost of living.

On the other hand, a Memphis resident earning $100,000 takes home $74,515 after federal and state taxes (SmartAsset).

Similarly, Americans’ views on the minimum income needed for a middle-class family of four are influenced by their ‘urbanicity’ (Gallup).

This means that those residing in cities and suburban areas project a higher required income for a family of four than those living in towns or rural areas.

Advice from Advisors

In order to staunch the financial bleeding at any income level, there are a few basics to get back to.

Know Your Net vs Gross Income

Do your own analysis of your finances. “Spend time looking at numbers, like what you keep after taxes and other things that are taken out of your paycheck.

Too often, people base their spending on their gross income, not what they actually take home.

Also factor in expenses that are quarterly and yearly, not just monthly — that’s a common pitfall” says Rebell.

Build Your Emergency fund

“Perhaps the most impactful thing people can do is have a healthy emergency fund so they don’t build up debt when those inevitable unexpected expenses hit,” says Rebell.

Most pros recommend having an emergency fund of between three and 12 months of living expenses.

This account keeps you from going into debt by using a credit card, or in case of job loss.

Stay True to Your Budget

“You must look no further than professional athletes, musicians and actors who have made millions but have filed for bankruptcy,” says Dereick Hodges, certified financial planner at Anchorpointe Wealth.

“Just as you can’t exercise enough to compensate for bad eating, you can’t out-earn bad spending behavior.”

See Also:

Inflation Outlook: What Consumers Need to Know

Aisa International:

Aisa International, s.r.o. is a wealth management firm with an award-winning team. We provide investment advice, financial planning, and asset management for U.S., U.K., and E.U. expatriate citizens residing abroad. Additionally, we hold all current regulatory licenses, including the FCA license in the UK and the Investment Licence in the European Union.

Aisa International is uniquely qualified to provide personal financial advice for U.K. pensioners living outside of the U.K. Headquartered in Prague, Czech Republic, Aisa International serves its global clients where they reside through its OpesFidelio network of highly-qualified advisors.

For more information, please visit www.asiainternational.cz.

Please Note:

The views expressed in this article are not to be construed as personal advice. Therefore, you should contact a qualified, and ideally, regulated adviser in order to obtain up-to-date personal advice with regard to your own personal circumstances. Consequently, if you do not, then you are acting under your own authority and deemed “execution only”. The author does not accept any liability for people acting without personalised advice, who base a decision on views expressed in this generic article. Importantly, where this article is dated then it is based on legislation as of the date. Legislation changes but articles are rarely updated, although sometimes a new article is written; so, please check for later articles or changes in legislation on official government websites, as this article should not be relied on in isolation.

Related Stories:

- UK Cost of Living Crisis: Brits’ Income Likely to Fall by £2k

- Retirement Savings Being Drained by Adult Kids Living at Home

- The 401(k) Crash: U.S. Retirees Impacted By Unexpected Losses in 2022

- US Social Security Rate Hike Biggest Since 1980s

- Real Cost of Living Alone: The New “Singles Tax”

Share this story