Interactive Retirement Calculators

Project your own retirement or saving fund. We re-invest all investment commissions so you can benefit from greater growth.

Here is a link to your own personal Lump Sum investment calculator

Download CalculatorThis article, combined with our BLOGS, has saved some clients tens of thousands of pounds so 10 minutes of your time now will be worth it. Above is an image of the calculator you can download.

Here is a link to your own regular savings pension calculator

Download CalculatorClients regularly take out savings plans or pensions plans offshore with various companies, not fully understanding the charges applied, or the lack of access in the short term.

They believe that when they take out a 15 year, 20 year or 25 year savings plan that they can access money after 2 years and obtain much of it back. WARNING: This is not the case in many instances and you should take advice if you are actually seeking a flexible plan that you can access money in less than 5 years, or even have the option to access money. Many people have lost lots of money in these plans because they need access within the first 8 years due to changed circumstances.

Companies covered

We have sought to produce a calculator based on the actual charging structures published by popular companies such as Old Mutual International (OMI) (formerly Royal Skandia), Royal London 360 (RL360), Generali, Friends Provident and some UK platforms.

WARNING: This is not an authorised projection from these companies, and you should obtain official illustrations from them for your own personal projections. Please read the DISCLAIMER at the bottom of the projector which also details the charges applied for each provider taken from their key facts brochures and published.

As an expat you want reassurance from an expert as to what your pension fund may be worth when you want to retire. Our offshore pension calculator does exactly that, it is designed for those approaching retirement, or looking to plan for retirement overseas. What is unusual about it, is that our pension retirement calculator does not produce a generic figure, but one that takes into account fees and commissions, and charging structures for several offshore pension custodians.

Furthermore, if you download our Offshore Retirement benefit Calculator, then you can also select further criteria, which makes the tool useful as a QROPS pension calculator, a SIPP pension calculator, or just a general retirement calculator.

To build the calculator, we have researched other offshore adviser recommendations for pensions and retirement and looked at the custodians they mainly use for offshore pension saving. The main ones are RL360, Generali and OMI. We have taken these companies’ published charging structures and put them into a downloadable retirement benefit calculator so that you can assess returns. Please contact us if you want to download our retirement benefit calculator.

As expat experts in the offshore pension scheme arena, we do not want to mislead you and say that the retirement pension calculations are approved or official. They are not. They are created by taking the published charging information from RL360, Generali, OMI (the information used is provided below) and then by using compound interest formulae and assumed growth rates, which you can choose as appropriate for your circumstances.

Are we qualified as experts to do this? Yes, we have between us, multiple industry awards, economic degrees, and advanced investment qualifications from the UK. These accolades were achieved on the basis that we understood the wide range of formulae required in creating pension and investment calculations for our clients, who are often seeking advice for both onshore, and offshore retirement planning from the UK.

So, please rest assured that our pension calculators provide a reliable estimation of what you are likely to obtain at the growth rates you select from the list of custodians provided (RL360, Generali, OMI). If you would like more information regarding the truth about offshore pensions, please read this article by Geoff Birch for expatarrivals.com

![]()

We would like you to stop for a moment, think about what you are about to do, and make sure you take advice that will provide you with the greatest chance of obtaining the very best offshore retirement benefits, and to ensure your offshore pension fund grows as much as possible, whether it is an offshore QROPS pension, or an onshore SIPP pension. We wish you a happy future retirement, and we hope that our pension calculator is the first step to making a real difference.

Investment Rules

YOU NEED TO BE REALISTIC AND NOT

BELIEVE IN EMPTY PROMISES

Expat pension advisers, in the main, simply agree with whatever return you are seeking and correlate it to the same risk you are stating you are. “No problem, I can obtain a 10% return for you with low risk”. As investment and pension expat experts we balance the Rate of Return (RoR) you require against your attitude to risk to obtain the correct balance of risk for the return you actually need.

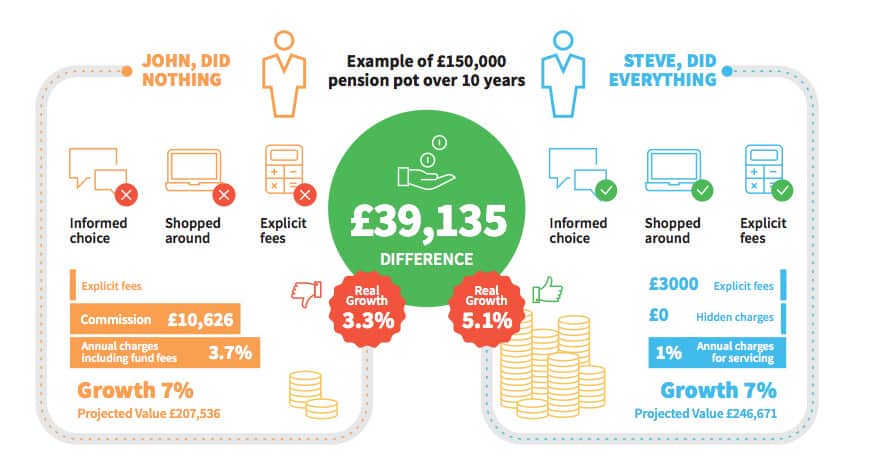

Be like Steve, and avoid being John!

Clive Tutton receiving the International Investment Winner – Best Best-Practice in Offshore Award 2016.

Clive Tutton receiving the International Investment Winner – Best Best-Practice in Offshore Award 2016.