Our Transparent Fees

We only do transparent fees – No commissions

The following outlines our pension charges for giving advice on UK pensions. In essence we are not free, but then nothing is free, is it? And FREE usually means poor quality or a con!

Our transparent fees outlined

TailorMade pensions for expats do not charge commission, rebating it all. Our standard fees are on this link:

How we charge ›There will be occasions where our standard fee will not apply, examples could include additional complexity to your arrangements or additional work / advice or additional travel required.

All bond & pension commission fully rebated

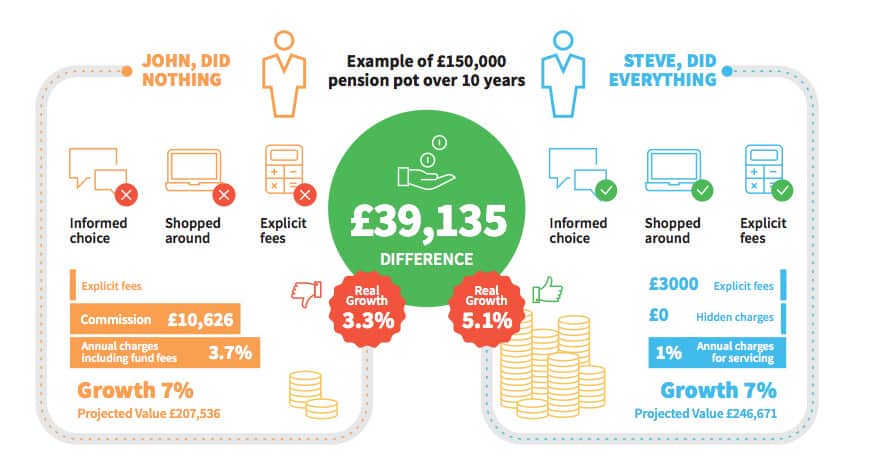

As we do not charge commission, we provide a comparison of how fees versus commissions actually works where commission has been taken and give an example below; it makes good reading for any client who wants transparency and open honest advice. This example is a british pension case of £150,000:

In retirement Steve will have £9,867 per annum, whilst John will only have £8,301.

Once the pension is in payment, considering the higher fund charges that John is receiving then over the next 10 years his fund will go down in value. Steve will have a fund that is still growing and will potentially last forever (not guaranteed).

Background information

Most so called offshore expat experts, International SIPP and QROPS salesmen, or those who give you Sipp or Qrops choices will advise you to go with “trustee A” usually connected with Malta or Gibraltar. As you read further down their report, then you will see a “custodian” quoted such as Lombard, Royal Skandia, Hansard, Old Mutual International ( OMI ), Royal London 360 ( RL360 ), Investors Trust, Friends Provident, Custodian Life, Providence, or Generali Utmost, based out of Isle of Man (RL360), Dublin, Luxembourg (Lombard), Caymans (Investors Trust), Bermuda (Custodian Life) and Mauritius (Providence) or Switzerland.

You are told about “trustee A charges” and a 1% custodian service charge.

Unfortunately, the offshore IFA adviser neglects to tell you about the other 2-4% of annual charges (within the fund choices and wrapper of Old Mutual International ( OMI ), Royal London 360 ( RL360 ), Investors Trust, Friends Provident, Custodian Life, Providence, or Generali Utmost) all of which can be avoided. This is because the salesmen get paid 6-9% commission for using these bond wrappers.

Our aim is to be transparent, fair and offer worry-free advice in a consistent manner. Criticise us if you want, but we want to put the consumer first.

How not to lose money ›Comparative example – Pension charges versus commission

Compare TailorMade Pensions and an offshore commission salesman. You live outside the UK and USA, and you wish to consider a pension transfer but you are unsure.

The value of your UK pension fund is £350,000

We will charge you $1,500 if you want our OPTIONAL STRATEGIC PENSION PLAN. We will do the TVC report and CASH FLOW forecasting within this charge.

If we think it is best you transfer (and only if we think this and you agree) then we will provide TRANSFER IMPLEMENTATION at a charge of 2%. This is $10,500.

Because you paid for the TRANSFER IMPLEMENTATION then you will not have to pay for the STRATEGIC INVESTMENT PLAN (none USA residents). $0.

The total cost for receiving a plan with good advice from a UK regulated broker will be $12,000. (We cannot guarantee this will be your exact fee as we have a sliding scale charge depending on the type and complexity of your investment – see link for further information:)

How we charge ›

The offshore commission salesman will not charge a fee usually, but he will earn around $31,500 – $47,250 commission for convincing you to transfer, irrespective of whether it is best advice. Under our pension charges we therefore will save you between $19,500 and $32,250 in commission charge alone, and around another $30,000 in other hidden fund charges over 5 years.

Transparent fees – no pension commission! Our pension charges are listed for giving advice on UK pensions anywhere in the world.

What you need to know ›We are regulated to give advice in the UK/EEA by the Financial Conduct Authority (FCA), by the FSB in South Africa and to give advice in the USA by the Securities and Exchange Commission (SEC) but this example is for outside both of those territories. Contact us for advice if you want advice from one of our regulated and authorised advisers for your country.