Post-Brexit Investment Advice | EU Residents with British Pensions

Expats with British pensions risk losing out in retirement post-Brexit. Act now!

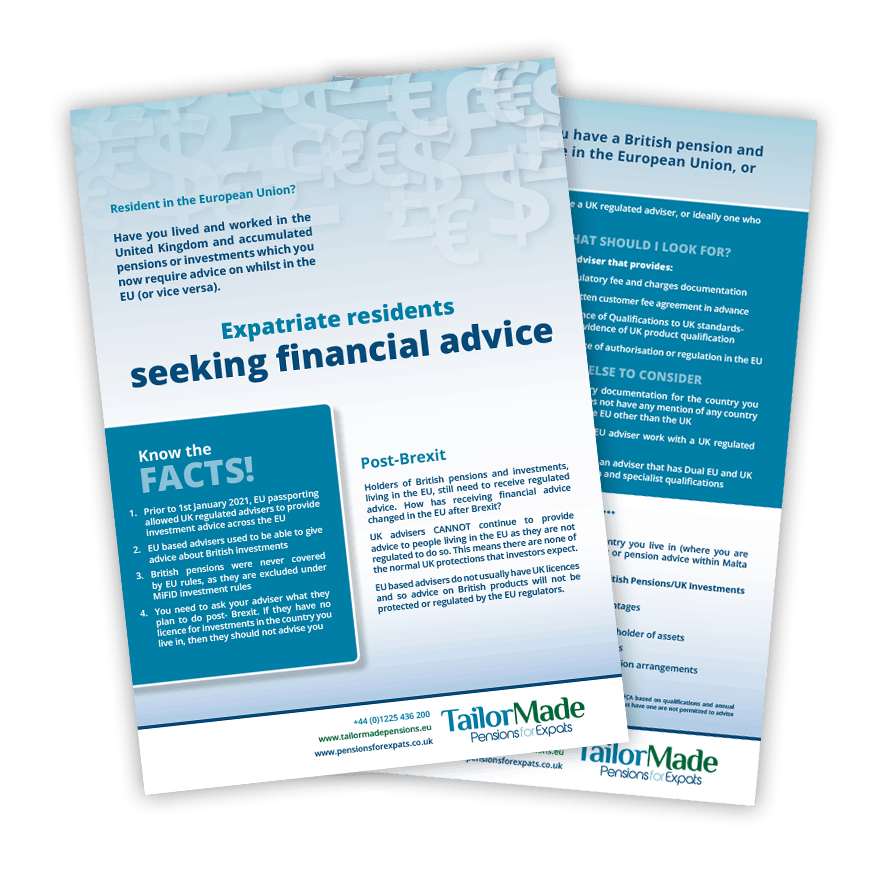

Holders of British pensions and investments living in the EU still need to receive regulated advice. The Aisa Group is regulated in both the EU and the UK, so we are perfectly placed to help you with your expat retirement planning now Britain has left the EU.

If you receive financial advice, you could be over £40,000 better off* in the future – and these gains could be even greater where poor advice has previously been received. In the wake of Brexit, it is more important than ever to seek expert guidance on what is best for you from dual-regulated individuals.

Watch our video to find out more about Post-Brexit Advice in the EU

Brexit does not mean the end to quality accessible advice.

*According to ILC report ‘The Value of Financial Advice’ (2017).

HOW CAN WE HELP YOU?

If you are considering retiring to Europe from the UK, or are already a resident in the EU, we can guide you on how your pension options might have been affected by Brexit. Don’t get caught out now Britain has left the EU.

If you have £150,000 or more in your pension or investments, our award-winning advisers can:

Provide information on your options, including comprehensive knowledge of French and UK products.

Explain why you should consider retaining your UK pension.

Advise on which products are suitable if a transfer is recommended.

Help you avoid large transfer charges and unnecessary taxes after Brexit.

No commission. Our advisers are fee based; they work to benefit you rather than the providers.

For more information view our video or obtain our brochure written by dual-regulated expert advisers.

There is lots to consider when moving abroad – whether you plan to retire overseas or return to the UK – but one of the most important factors is your pension!

Should you transfer your UK pension or leave it where it is?

How can you avoid paying tax twice on your pension income?

How to manage your pension investments if outside the UK?

What happens when your beneficiaries live in another country?

The difference between QROPS and International SIPPs?

The best way to access your pension overseas after Brexit?

Over 200 independent judges have presented us with 20+ International & UK Awards making us the choice of professionals for pension and investment advice since 2009.

Advice provided by the multi-award winning Aisa Group.