SIPP Investment | Benefits Of A SIPP | International SIPPs | France

Should you be considering a SIPP as an expat in France?

We publish simple information below to help you to decide better.

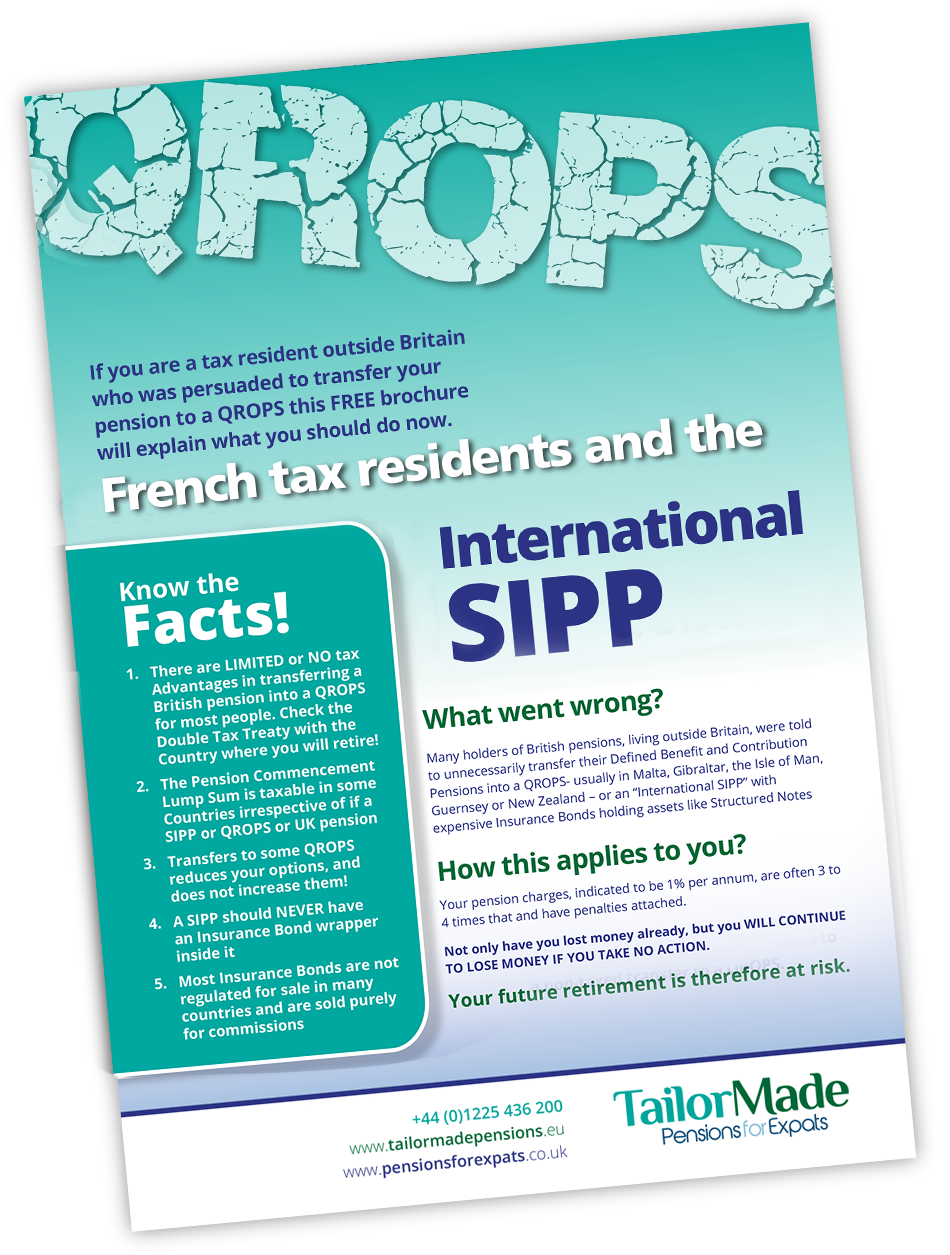

Whilst QROPS may be the first type of pension you consider as an expat, the truth is that a SIPP may be the better option. Here, we detail the information about SIPP investment, and the potential benefits of a SIPP.

Difference between a SIPP and an International SIPP?

Essentially, a SIPP and an International SIPP are identically regulated. Whilst a few years ago an International SIPP may have differentiated itself by offering currency and other additional SIPP investment benefits linked to expats (hence sometimes being referred to as an ‘expat SIPP’), the reality is that many SIPPs now offer exactly the same without calling themselves International SIPPs.

Transferring your UK pensions to SIPPs

Transferring your UK pensions to SIPPs may bring several advantages:

Leave remaining pension funds to your chosen beneficiaries free of death taxes if you are under 75

Continue to make contributions to your pension, offset by any UK tax you may be earning, or up to £3,600 per annum if you are a UK resident or have been in the last 5 years

Enjoy the lowest cost option of all offshore pension solutions (a true low cost SIPP, not those peddled by offshore salesmen, as SIPPs can be obtained for £80-150 per annum)

Take commercial loans within your pension fund

Enjoy greater flexibility and investment freedom than a standard UK pension

Take the option of just tax free cash, just income, or combine them More ›

These are just some of the benefits. To learn more, speak to one of our expert advisers today.

Assist me › Video ›

“SIPPs/International SIPPs are ideal for those with larger UK pension pots who want increased investment flexibility”

Customer Q&As ›SIPP Criteria ›

What is a SIPP (or ‘expat SIPP’) and who should have one?

A Self Invested Personal Pension (SIPP) is simply a UK pension vehicle for allowing investors to control their investment strategy, and retirement, themselves. It offers more control to the individual and does not rely on trustees to make decisions for them. The term expat SIPP is often used to describe a UK pension for expats.

SIPPs/International SIPPs are ideal for those with larger UK pension pots who want increased investment flexibility including currencies, or for those who are temporarily, but not permanently non-resident expatriates (expats), or for those who think they are likely to return to the UK to live in the future (or their surviving beneficiaries will return to the UK after their death).

If your fund is likely to exceed £1,000,000 by retirement, then a QROPS should be considered. SIPPs are the main-stay of retirement planning and are free from Inheritance Tax and ideal for cross-generation planning.

Qualifying criteria for a SIPP

Holds UK pensions (excluding state pensions) worth at least £100k  |

Needs access to currency or investments outside and inside the UK  |

Desire to have a flexible low cost structure, and more control  |

Individual may be returning to the UK or staying in France  |

Holds a private/personal pension that is already in drawdown  |

Holds a QROPS and wants to consider a SIPP  |

Still a UK resident with no intention of moving overseas  |

Living overseas and wants to take advantage of the 2015 rules  |

Commission means 4 things:

You pay much higher charges for years linked to the commission.

You have an access surrender charge on your fund(s) of up to 10%.

You pay additional higher charges linked to funds. Often double.

You may have been placed in higher risk investments to compensate for charges.

In addition to all these higher charges, we find that in many cases, you will have been also put in other commission generating products.

AVOID HUGE COMMISSIONS

We will conduct business at minimal cost to you

Contrary to how most overseas expat advisers operate, we work exclusively on a transparent fee-based model, and do NOT charge any commissions.

Click for more information on who we are and how we charge › and comparing Fees versus Commissions ›

Why would a SIPP be better than a QNUPS or QROPS?

With the new rules brought in as of April 2015 then some benefits, such as income and flexibility to take capital have improved dramatically under a SIPP. Furthermore, QROPS and QNUPS are far more expensive than most SIPP products, if not initially then in terms of annual charges. Also, a SIPP should never be utilised with investments held in an investment bond, and therefore should be a fraction of the cost of QROPS, thus improving returns.

In most cases, people up to the age of 74 are better off with a SIPP for retirement planning, rather than a QROPS, because of the Budget announcement of 2014 and rule changes as of 6 April 2015.

The 75 years age split since April 2015

In essence, if you are under 75 then a whole raft of flexibility is available to you. Death tax benefits have been reduced to ZERO for any funds accessed after 6 April 2015, and there is greater access in your lifetime up to 100% of your funds wherever you are in the world.

If you are approaching 75 or your funds approach or exceed £1 million then you need to consider your options more carefully, as a QROPS should also be considered. Over 75 there are reduced options of access tax, or in the future beneficiaries will have to pay income tax on any proceeds they take (although if they leave the fund to accumulate for future beneficiaries then there is 0% tax applied). A QROPS may be a better solution but is not always available in your jurisdiction with heavy taxes due and so your future plans are significant to any plans made.

If you are overseas you will need to consider your DTT with the UK. More ›

Avoid further loss of your future retirement income by taking action now.

UK pension transfers by overseas advisers

Beware recommendations of an investment made into an investment bond via a SIPP. This is often very costly bad advice dictated by the limited licences and lack of knowledge of the advisers/advisors! In fact some of the better advice, following UK regulations, is only available through quality specialist pension advisers who understand regulations in the UK, and do not base their advice on who pays the highest commission

Our recommendation to you would be to contact a fee-based adviser who will help you get back on track with your pension.

We will endeavour to help where we can, but please understand we cannot help everybody and we will be upfront with you

Assist me ›

Challenging the status quo

Over the last 20 years we have wanted to change the status quo by focusing on making life better for consumers. Ferocious independence, due diligence and robust research, combined with strict governance and procedures aligned with transparency on fees and charges, have helped establish us as the “go-to” award-winning financial adviser.

Our research and persistence liaising with providers to deliver what is good for you, the consumer, means we can provide TailorMade intelligent solutions putting you first.

We provide a customer charter to our clients, and PLEASE NOTE we offer the most competitive terms, bettering any legitimate deal that can be evidenced.

We deal exclusively with pension providers that comply with both the spirit and the letter of the UK and US regulations.

We believe this to be in the best interests of our clients and in our own professional best interests. Uniquely, we offer an award-winning UK IFA spectrum, combined with international experience and knowledge.

Our expert knowledge is provided by the Aisa Group. Internationally we have several firms in different countries both within Europe (including the UK) and outside of Europe, often known as Aisa International.

Aisa Group have been acclaimed in the UK for pensions, investment and tax advice – multiple finalists and 20+ times award winners since 2009, including UK Investment Excellence awards, UK Pension Awards won and tax planning awards from publications including FT.

Why should you put up with hidden commission and charges?

We have built a system that will provide you with a FREE risk assessment report, and a FREE summary outlining your own personalised financial health check. You have nothing to lose and everything to gain.

The worst case scenario is that you discover a fantastic system that will allow you to update your information and complete reviews in the future*. Most people want to know if their pension and savings are in the best place already, whilst also making future plans.

If you have a minimum of £100,000 and are one of those people who want to know about the most advantageous charges and access (if you are reading this, then you probably are) then why waste more time?

Yes! I would like to download my

FREE Brochure

Assist me ›

* The first review is free. We reserve the right to charge fees in the future for the use of software and reports.

Why should you put up with hidden commission and charges?

We have built a system that will provide you with a FREE risk assessment report, and a FREE summary outlining your own personalised financial health check. You have nothing to lose and everything to gain.

The worst case scenario is that you discover a fantastic system that will allow you to update your information and complete reviews in the future*. Most people want to know if their pension and savings are in the best place already, whilst also making future plans.

If you have a minimum of £100,000 and are one of those people who want to know about the most advantageous charges and access (if you are reading this, then you probably are) then why waste more time?

Yes! I would like to receive my FREE Brochure providing KEY information

Assist me ›

* The first review is free. We reserve the right to charge fees in the future for the use of software and reports.

Advice provided by the multi-award winning Aisa Group.